Starting from September 1, 2019, the VAT Act imposes new obligations on taxpayers. In addition to the already existing obligation to verify the taxpayer’s status, there is an additional need to check bank account numbers in the database provided by the Head of the National Tax Administration. Entrepreneurs processing large amounts of invoices must devote additional time to this activity verifying not only the status of the taxpayer , but also a bank account on transfer invoices. They have to do this repeatedly for each invoice – usually for the first time when the invoice is received, as well as when a bank transfer is being made. The proof of verification is the response identifier returned from the server, which should be stored as a screen copy or printout. Making payments for an amount of PLN 15,000 or above this amount to an unverified account means serious tax consequences for the payer. Therefore, for a large number of VAT taxpayers, there is a high tax risk and additional costs associated with the ongoing handling of invoices.

Especially for our clients, we have prepared a solution that completely automates this process. From invoice registration to payment at the bank. The Baseline ™ system automatically connects to the KAS server through the API provided and verifies the status of both the taxpayer and the bank account on the invoice. The verification status along with the response identifier is stored in the system in the form of a special printout and for the purposes of possible control. Therefore, the risk of human error has been eliminated, and the action itself does not require additional work on the part of the user.

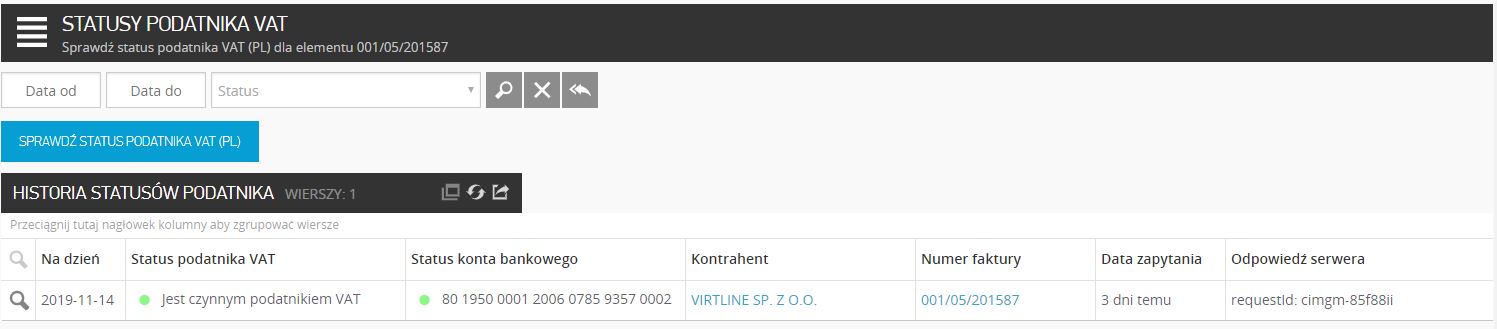

Screen 1: Verification history preview

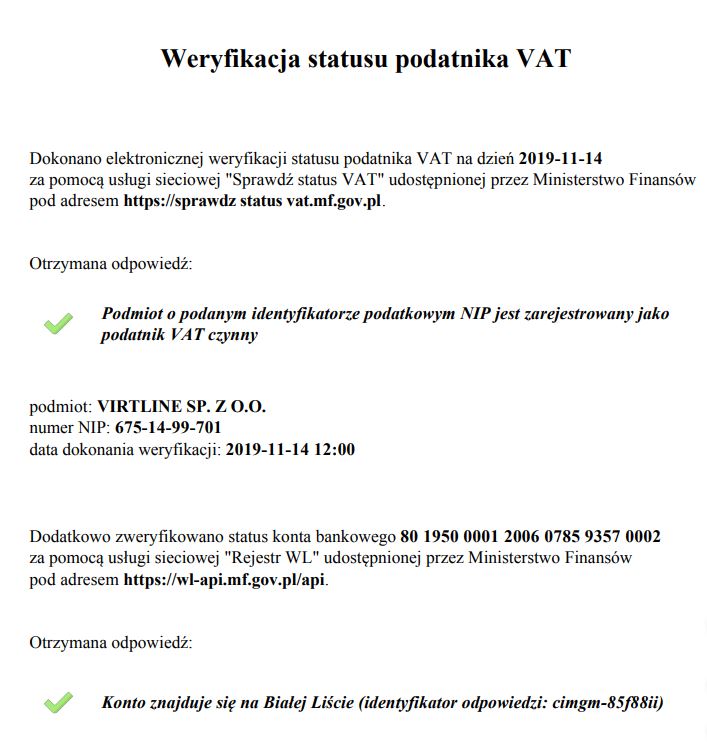

Screen 2: Print preview